The new home sales recession continues

Housing Wire

AUGUST 23, 2022

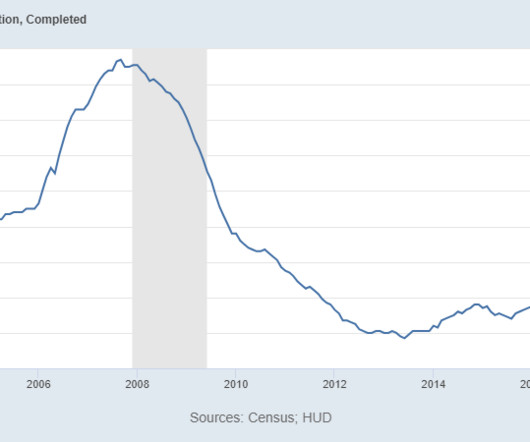

So for now, the builders will take their time with the homes under construction and make sure they offer enough incentives to unload the new home supply they’re dealing with. can’t have a credit sales boom like we saw from 2002-2005. This time, we have less production of homes and more multifamily construction. months and above.

Let's personalize your content