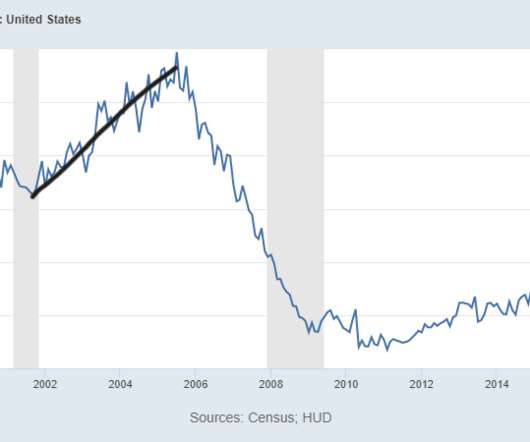

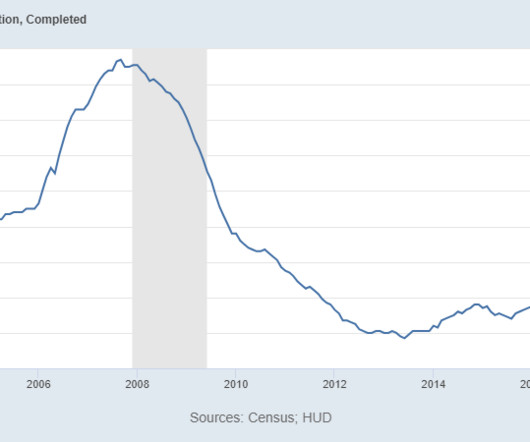

Comparing this housing market recession to 2008

Housing Wire

DECEMBER 29, 2022

The housing sector — especially real estate and mortgage — has seen significant layoffs , while the general economy will create more than 4 million jobs in 2022. Then we had the biggest mortgage rate shock in recent history and yet even with that, we will have over 5 million total home sales this year. Production falls. Home sales.

Let's personalize your content