StoicLane has plans to create an appraisal giant

Housing Wire

OCTOBER 20, 2021

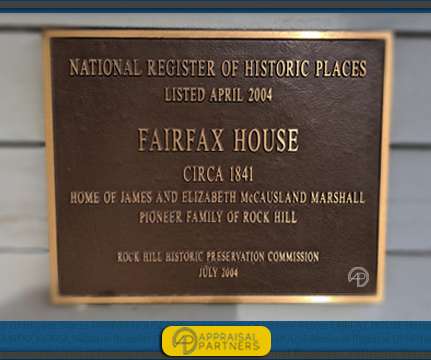

Less than one month after launching operations , the private holding group StoicLane – the backers of Interfirst Mortgage – has acquired control of the appraisal management company Lender’s Valuation Services (LVS). The team co-founded several companies and, since 2004, they claim to have created $4 billion in equity value to investors.

Let's personalize your content