Logan Mohtashami unpacks the slow train wreck that’s been happening in housing inventory

Housing Wire

JUNE 2, 2022

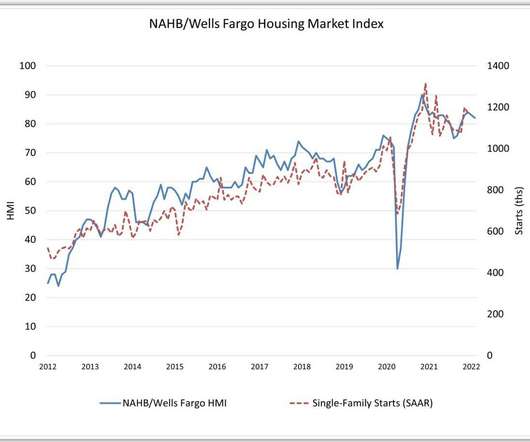

HW+ Member: What’s the number one question you are getting from the real estate agent community on the economy and housing market? Unlike the housing bubble years, where credit pushed home prices with demand, we just had a raw inventory shortage with demand picking up for sure, but nothing like we saw from 2002-to 2005.

Let's personalize your content