How will rising rates affect new home construction?

Housing Wire

MARCH 17, 2022

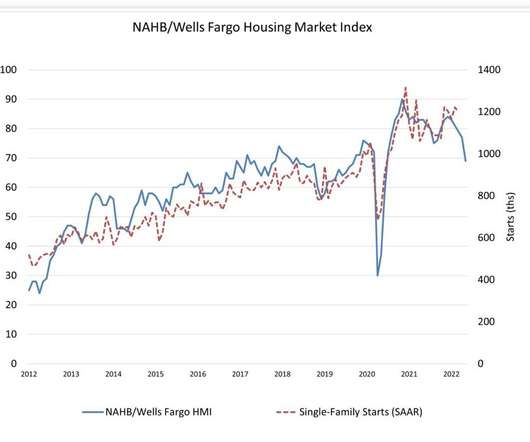

Census Bureau released their construction report for February, showing a positive trend in housing construction data with a lovely print in housing permits at 1,859,000 and housing starts at 1,769,000. So far, housing construction has done well during 2020-2022 considering the economic drama. Today, the U.S.

Let's personalize your content