Logan Mohtashami unpacks the slow train wreck that’s been happening in housing inventory

Housing Wire

JUNE 2, 2022

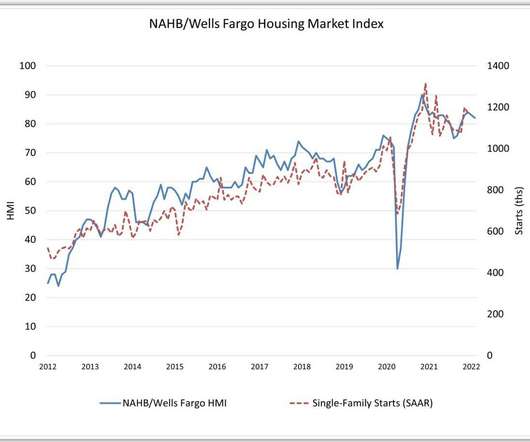

HW+ Member: What’s the number one question you are getting from the real estate agent community on the economy and housing market? Since 2014 inventory has been falling slowly for years, then here come years 2020-2024, our most prominent housing demographic patch ever in history with low mortgage rates. Ghost Supply 2.2

Let's personalize your content