How auction buyer data foreshadows housing market shifts

Housing Wire

JULY 21, 2022

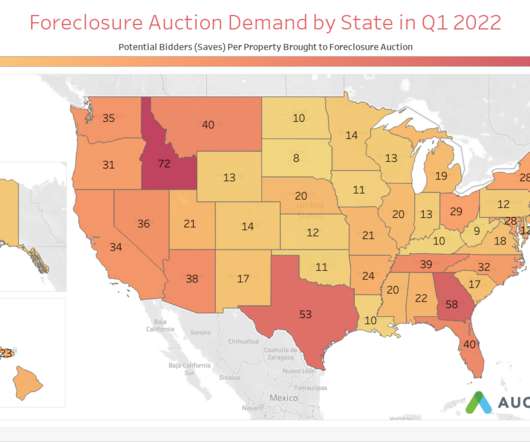

Retail housing market data from June showing early signs of a real estate slowdown was foreshadowed three months earlier in buyer behavior at foreclosure auctions. The downshift in buyer behavior at the foreclosure auction came two months before the downshift showed up in retail housing market data.

Let's personalize your content