Mortgage rates surge to highest level since 2000

Housing Wire

SEPTEMBER 28, 2023

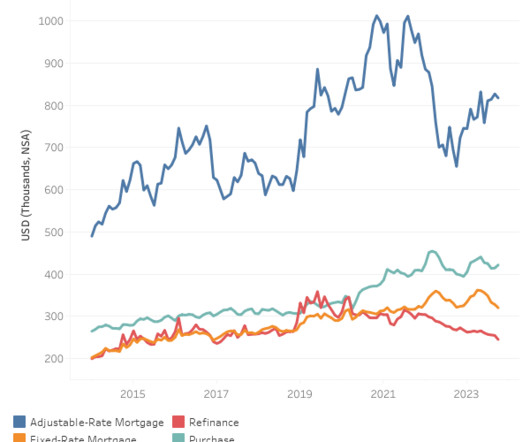

The 30-year fixed-rate mortgage has hit the highest level since the year 2000,” Sam Khater, Freddie Mac’s chief economist said. 28, up 12 basis point from last week ’s 7.19%. By contrast, the 30-year fixed-rate mortgage was at 6.70% a year ago at this time.

Let's personalize your content