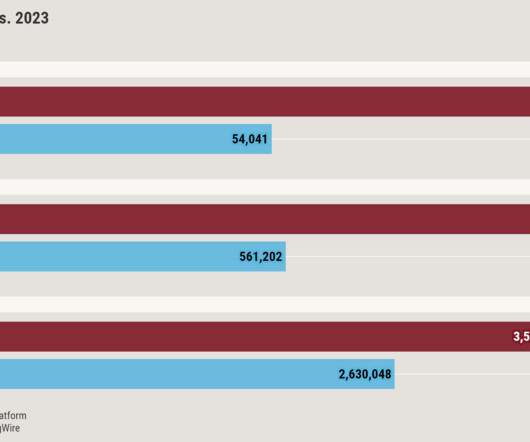

Rate lock volume rose going into the spring buying season

Housing Wire

MARCH 11, 2024

The spring homebuying season kicked off with a monthly jump in purchase mortgage locks despite rising interest rates. increase in purchase activity, data from Optimal Blue ’s Originations Market Monitor report showed. The rise in purchase activity outpaced the decrease in refinancing activity , which fell by 22.5%

Let's personalize your content