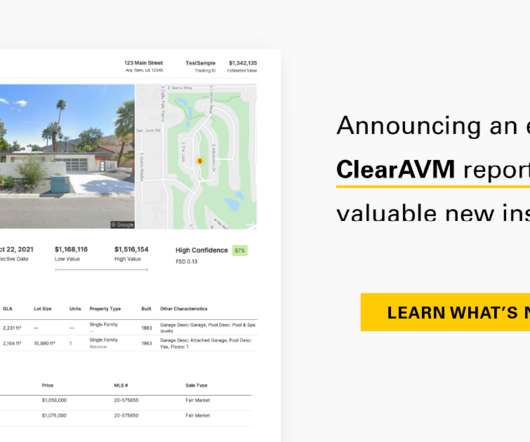

Fannie Mae: Appraisals are no longer the default option

Housing Wire

MARCH 1, 2023

As such, we are transitioning to a range of options to establish a property’s market value, with the option matching the risk of the collateral and the loan transaction,” Fannie Mae states in its release. “We are on a journey of continuous improvement to make the home valuation process more efficient and accurate.

Let's personalize your content