Closing on a House: Settlement Tips for Home Sellers

Realtor

MAY 17, 2023

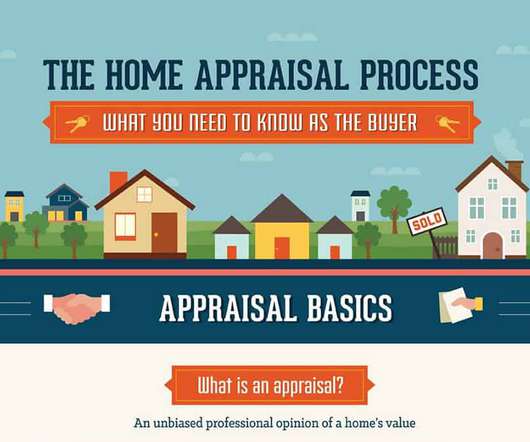

As a seller, here’s what you need to know about the settlement process. If the appraisal comes in higher than the sales price, then the buyers can relax in the satisfaction they’ve purchased a home for less than its market value. Once the contract has been signed, a seller can’t renegotiate the price higher.

Let's personalize your content