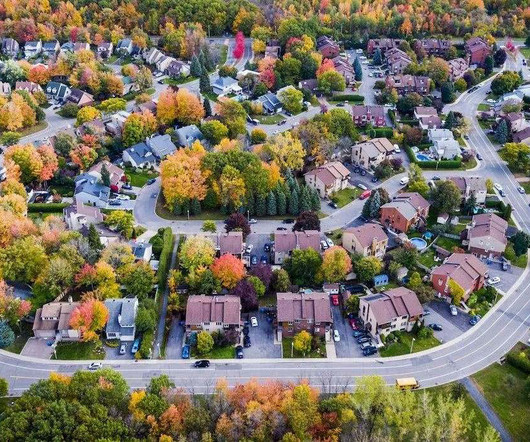

The opportunity cost of modern-day redlining

Housing Wire

APRIL 9, 2024

Modern-day redlining persists, and it’s costing lenders millions in legal fees. Recently, the Department of Justice (DOJ) has taken a strong stance on redlining, taking direct legal action against bad actors and thrusting the topic into the national spotlight. More recently, Patriot Bank paid $1.9

Let's personalize your content