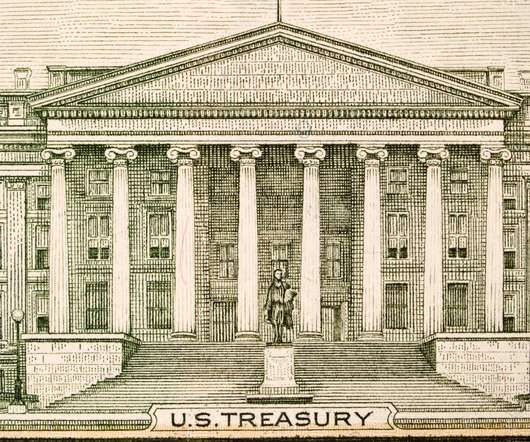

ALTA: Protecting property rights with title insurance

Housing Wire

DECEMBER 16, 2022

For most real estate industry professionals, title insurance needs no introduction. A trusted product , title insurance has been used to protect real estate transactions and property rights for over a century. Title insurance is different than most other insurance products. Diane Tomb, ALTA CEO Contributor.

Let's personalize your content