The Federal Reserve delivers lower rates for Christmas

Housing Wire

DECEMBER 16, 2023

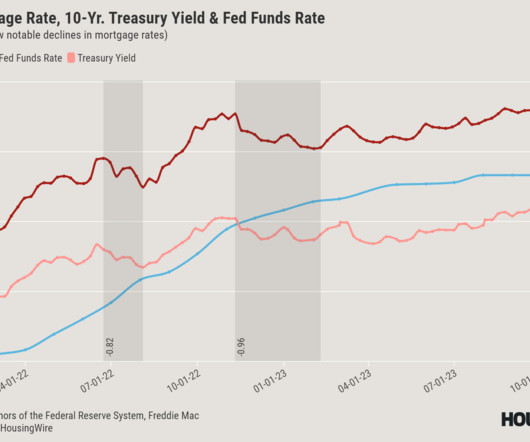

The Federal Reserve played the good grinch for Christmas this year and delivered the best gift for homebuyers nationwide, leading to lower mortgage rates. The 10-year yield and mortgage rates fell together after the Fed meetings, which gave us mortgage rates under 7% last week. Mortgage rates and the 10-year yield What a crazy week! Not too long ago, on jobs Friday, I was on the HousingWire Daily podcast saying it’s time to declare war on the Federal Reserve for being too restrictive; you can li

Let's personalize your content