Why are mortgage rates surging?

Housing Wire

SEPTEMBER 30, 2023

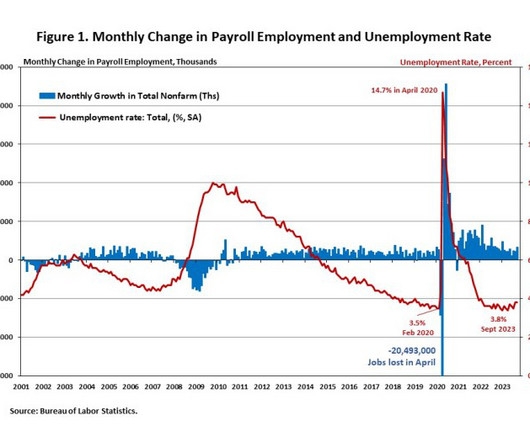

Why are mortgage rates rising? This is a question many people are asking — even some of the Federal Reserve members. We have had back-to-back weeks of the bond market getting wild since the key 10-year yield level of 4.34% broke higher. It didn’t help that the Fed was hawkish after the Fed meeting , as their forward outlook surprised some market players.

Let's personalize your content