Why are exisitng home prices up year over year?

Housing Wire

SEPTEMBER 21, 2023

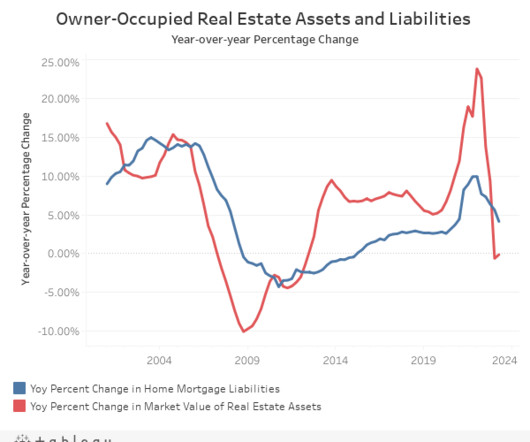

Existing home prices are up 3.9% year over year, with demand near 21st-century lows. How is this possible? NAR ‘s existing home sales report on Thursday gives us insight into the why factor. The median existing-home price for all housing types in August was $407,100, an increase of 3.9% from August 2022 ($391,700). All four U.S. regions posted price increases.

Let's personalize your content