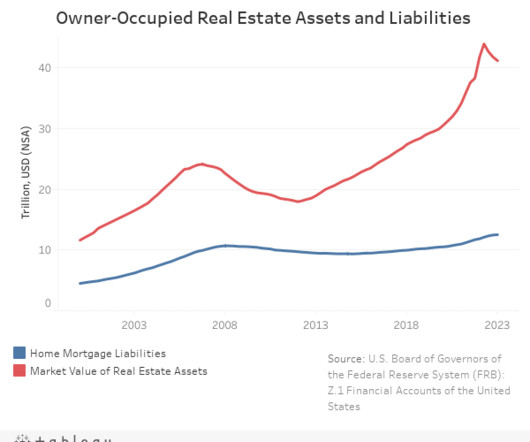

Why higher rates aren’t crashing home prices

Housing Wire

JUNE 9, 2023

Home prices aren’t crashing, despite what the housing bubble boys are saying. In fact, home prices have firmed up higher recently. The housing bubble boys are a crew that from 2012 to 2019 screamed housing crash every year. They went all in during COVID-19 in 2020, doubled down in 2021 as the forbearance crash bros but really bet the farm on a massive home-price crash in 2023 after the most significant home sales crash ever in 2022.

Let's personalize your content