Consumers point to mortgage rates, not home prices, as key barrier to affordability

Housing Wire

OCTOBER 9, 2023

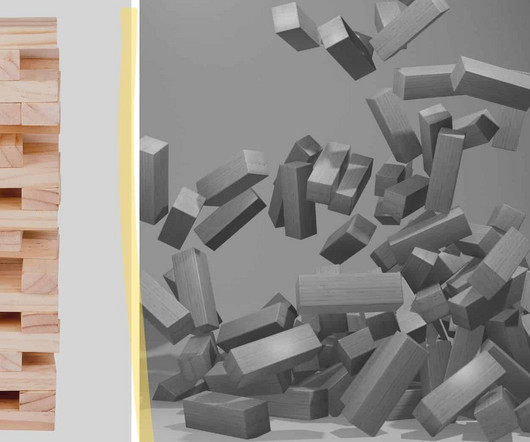

Elevated mortgage rates continue to dampen already-pessimistic consumer housing sentiment and create affordability woes for both homebuyers and sellers. That feeling is underscored in Fannie Mae ’s latest Home Price Sentiment Index (HPSI), which decreased by 2.4 points in September to 64.5. The index tracks the housing market and consumer confidence to sell or buy a home.

Let's personalize your content