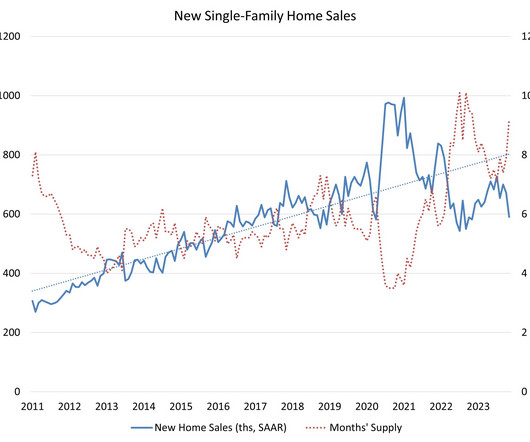

November sees the lowest level of new home sales in a year

Housing Wire

DECEMBER 22, 2023

New home sales fell month-over-month in November to their lowest level since last November. But despite this dip, 2023 is poised to be one of homebuilders’ busiest years. Total new home sales are expected to reach about 5% higher than last year, while sales of existing homes are down by nearly 20% year-over-year. In November, new home sales reached a seasonally adjusted annual rate of 590,000, according to data published on Friday by the U.S.

Let's personalize your content