Ron Terwilliger on how to make more affordable housing

Housing Wire

FEBRUARY 8, 2022

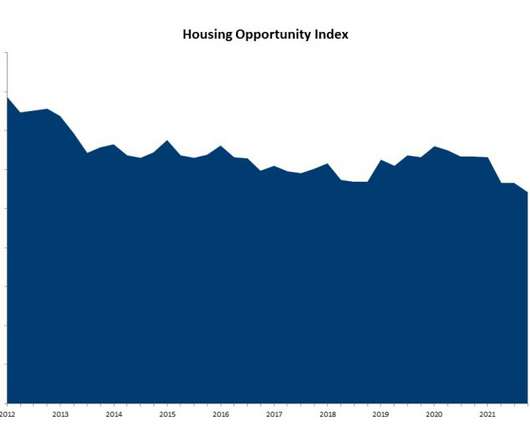

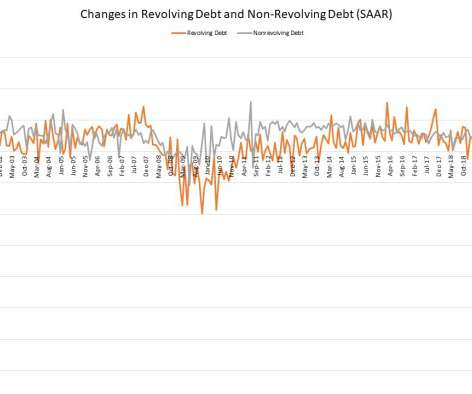

America suffers from a severe shortage of affordable homes. This development did not occur overnight: Over the past 20 years, we have “underbuilt” housing by at least 5.5 million homes. Policymakers are rightly focused on helping people afford to purchase or rent a home through down payment assistance, housing vouchers and other programs. The unfortunate truth is that too many households lack sufficient income to cover their housing needs, a situation exacerbated today by high inflation.

Let's personalize your content