What does the new normal for first-time homebuyers look like?

Housing Wire

SEPTEMBER 21, 2022

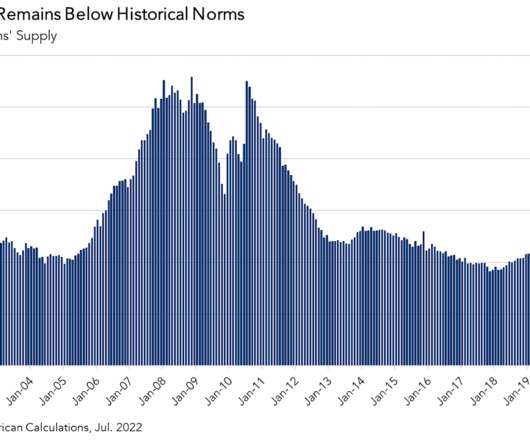

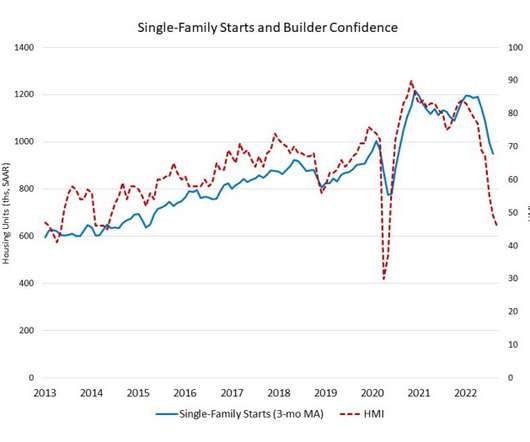

Before the pandemic, the historical average of annualized house price growth was approximately 4%. Yet, pandemic-era dynamics exacerbated an already large housing demand and supply imbalance, fueling record-breaking annual house price growth, peaking at nearly 21%. Today, as affordability wanes and housing supply ticks up, house price growth is decelerating and will likely continue to trend towards its historical average.

Let's personalize your content