The mortgage market just had its strongest week in months

Housing Wire

DECEMBER 6, 2023

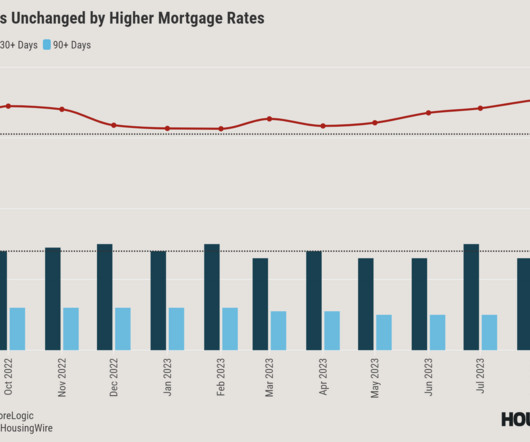

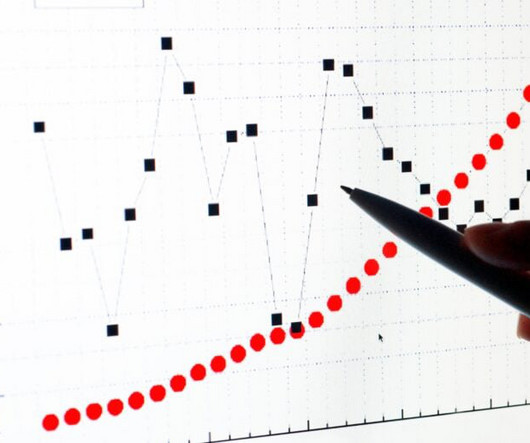

Falling mortgage rates last week brought increased demand. Total home loan applications increased 2.8% for the week ending Dec. 1 compared to the previous week , according to data from the Mortgage Bankers Association (MBA). The 30-year fixed-rate mortgage averaged 7.17% last week. Slower inflation and the confidence financial markets have that we are nearing the end of the Fed ’s hiking cycle has brought mortgage rates to the lowest level since August.

Let's personalize your content