The Fed is not done with rate hikes, even as the housing industry begs for mercy

Housing Wire

JUNE 15, 2023

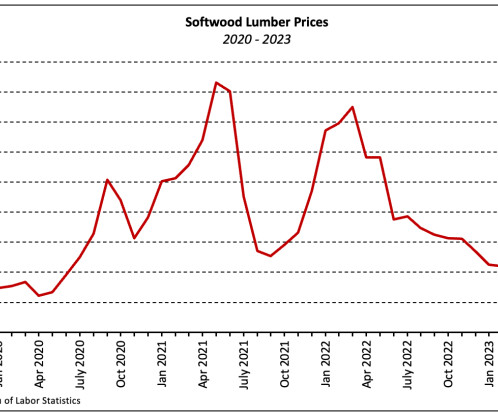

The Federal Reserve ‘s (Fed) interest rate hike pause will give the housing industry a cautious sigh of relief, but observers are already nervous that the rate-induced pain train won’t come to a complete stop for a while longer and volatility will remain. The Fed’s updated economic projections showed that central bankers forecast that inflation could finish 2023 at 3.2% up from March’s projection at 3.3%; core PCE inflation at 3.9% after stripping out food and fuel prices, an

Let's personalize your content