NAR’s Lawrence Yun predicts lower rates, 15% jump in existing-home sales in 2024

Housing Wire

NOVEMBER 15, 2023

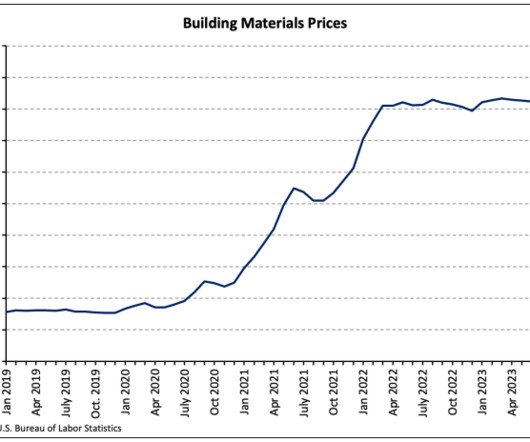

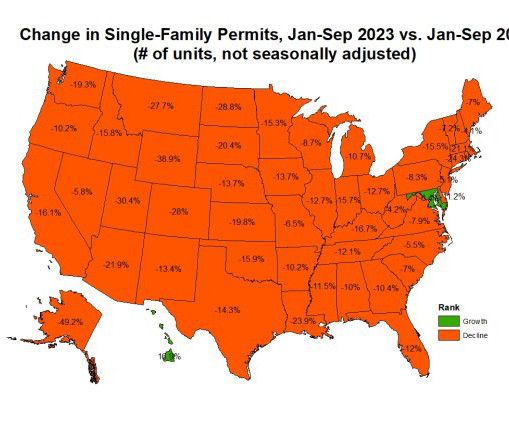

Although high mortgage rates, elevated home prices and limited housing inventory have crippled the 2023 housing market, the outlook for 2024 is brighter, according to Lawrence Yun, chief economist with the National Association of Realtors (NAR). Yun took the stage on Tuesday at NAR NXT , the trade group’s annual conference in Anaheim, California. He began his presentation during the “Residential Economic Issues and Trends Forum” by analyzing the data points that impacted 2023 real es

Let's personalize your content