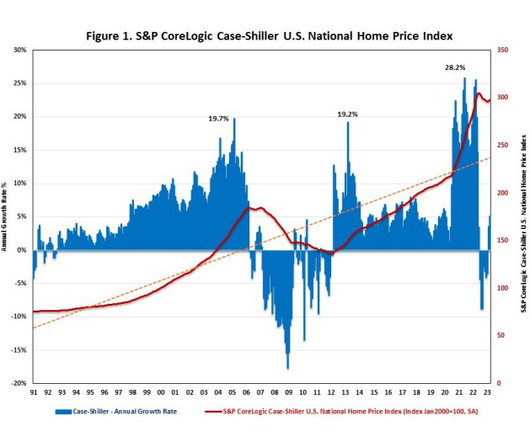

Home prices accelerated in March even as mortgage rates climbed

Housing Wire

MAY 30, 2023

Low housing inventory and still-strong demand kept prices high in March, according to the latest according to the S&P CoreLogic Case-Shiller National Home Price Index , released Tuesday. The annual growth rate in March 2023 was up 0.7%. On a month-over-month basis, the index was up 1.3% before seasonal adjustment. This was the second month-over-month increase following seven consecutive month-over-month decreases.

Let's personalize your content