Floify launches lending platform for mortgage brokers

Housing Wire

DECEMBER 4, 2023

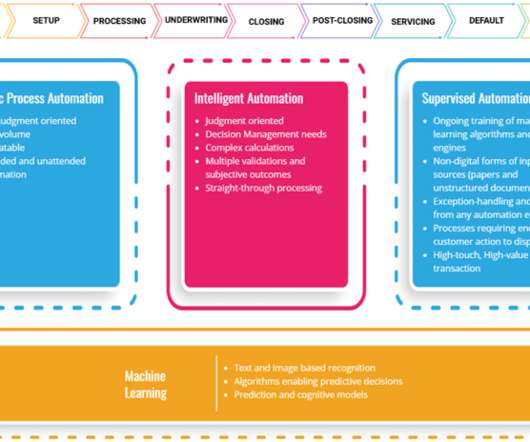

Digital mortgage automation solution provider Floify launched a lending platform for mortgage brokers built on the foundation of the Floify point-of-sale (POS) platform. is a software development company that offers a digital loan origination and POS system for the mortgage industry. in an $87 million deal in 2021.

Let's personalize your content