Book authors want loan officers to have an edge in a highly competitive market

Housing Wire

MARCH 1, 2024

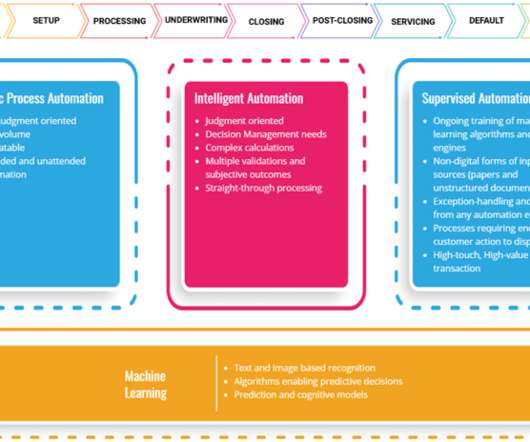

In a fiercely competitive market , mortgage originators need to rethink everything to gain market share and become savvy. Adopting an educator-first mindset, coupled with a willingness to reach, assist, engage and nurture early-journey first-time homebuyers, are the defining attributes of a next-gen loan officer.

Let's personalize your content