The cure for appraisal gap anxiety

Housing Wire

MARCH 24, 2023

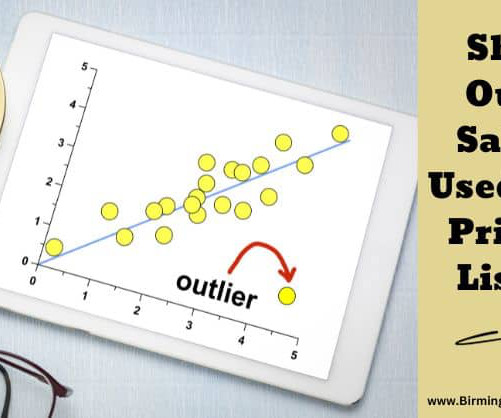

An appraisal gap is the difference between what a buyer agreed to pay for a home in a purchase contract and what an appraiser concludes as the fair market value of the property. The truth of it is that an appraisal coming in below the contract price can be a powerful tool for a homebuyer and save them future pain and heartache.

Let's personalize your content