9 tips for homebuyers in non-disclosure states

Housing Wire

MAY 21, 2024

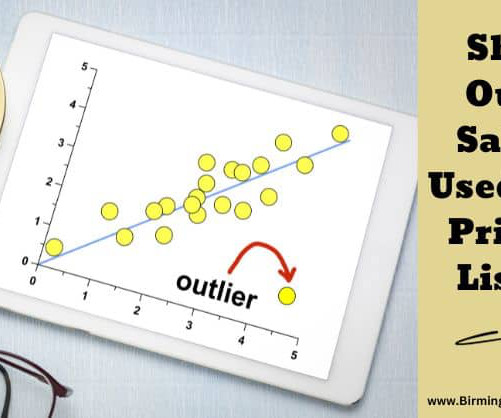

Without sales figures, it’s difficult to access comparable sales, and home buyers may find it challenging to gauge the fair market value of a property. Buyers should focus on other factors when estimating a property’s value , such as location, condition of the home, local amenities, and current market trends.

Let's personalize your content