NAR’s Lawrence Yun predicts lower rates, 15% jump in existing-home sales in 2024

Housing Wire

NOVEMBER 15, 2023

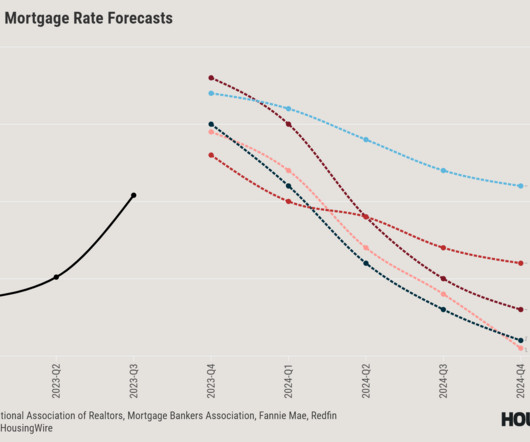

Although high mortgage rates, elevated home prices and limited housing inventory have crippled the 2023 housing market, the outlook for 2024 is brighter, according to Lawrence Yun, chief economist with the National Association of Realtors (NAR). He also expects more sellers to enter the market, as they adapt to prolonged higher rates.

Let's personalize your content