Unsold homebuilder inventory is ticking up as new home sales slow

Housing Wire

SEPTEMBER 26, 2023

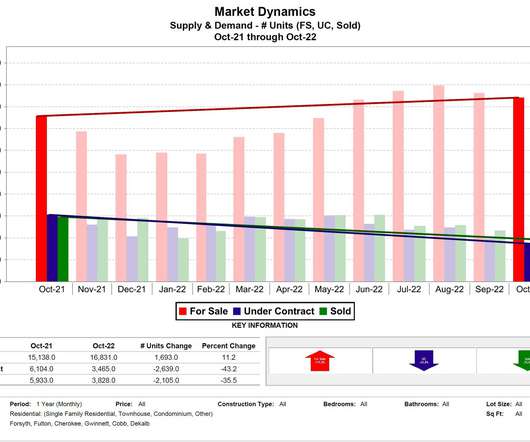

However, mortgage applications for new home purchases increased 4% between July and August, the strongest pace of sales in three months. Homebuilders are still benefiting from very low inventory of existing homes for sale, which has driven more buyers to consider new construction,” Bright MLS Chief Economist Lisa Sturtevant said.

Let's personalize your content