Looser mortgage credit may give first-time buyers a chance

Housing Wire

APRIL 8, 2021

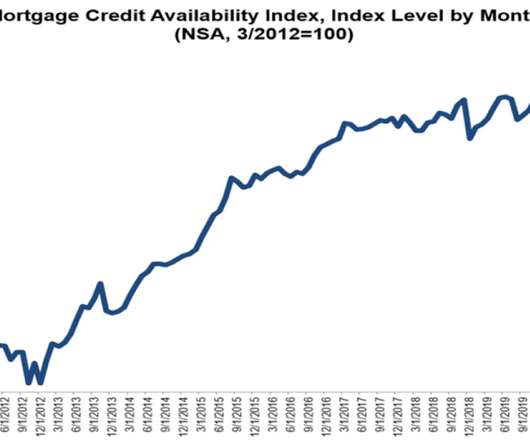

Mortgage credit showed signs of loosening up in March, and with it, more availability for lower credit scores and high LTV products to enter the housing market, the Mortgage Bankers Association said in a report on Thursday. The group’s Mortgage Credit Availability Index rose.6% Presented by: Citibank.

Let's personalize your content