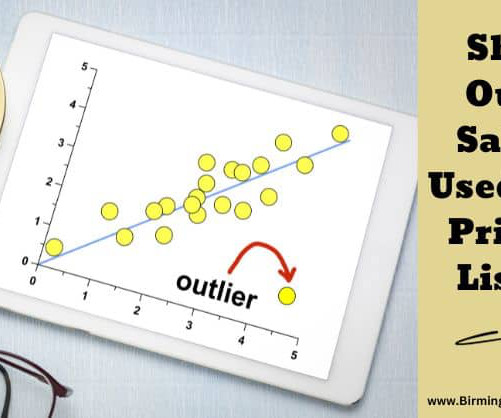

The Pitfalls of Outlier Sales in Pricing a Listing

Birmingham Appraisal

SEPTEMBER 26, 2023

Real estate professionals use a mix of data analysis, market knowledge, and professional judgment to determine a property’s value or list price. The topic of outlier sales came to mind recently when I noticed a sale in my market that was listed between two and three million dollars. There is a difference.

Let's personalize your content