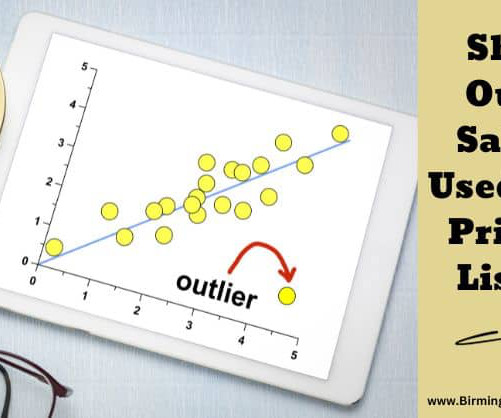

The Pitfalls of Outlier Sales in Pricing a Listing

Birmingham Appraisal

SEPTEMBER 26, 2023

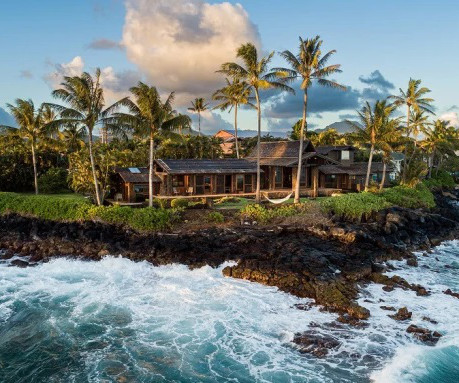

The market area that the property is located in can definatley support the price but does the price truely reflect the market value of that specific property or does it reflect what a super motivated buyer with available funds is willing to pay? Related posts: What is bracketing and why should Realtors do it?

Let's personalize your content