Race and the Property Valuation Industry

Appraisal Buzz

MAY 31, 2021

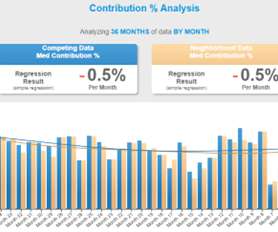

Appraisers who complete reports do so with the understanding that their work could and would be reviewed if a homeowner, as in this case, accuses the appraiser of being racially biased in their value estimation. These color codes were designed to indicate where it was safe to insure mortgages. an income gap of 60%). Perception.

Let's personalize your content