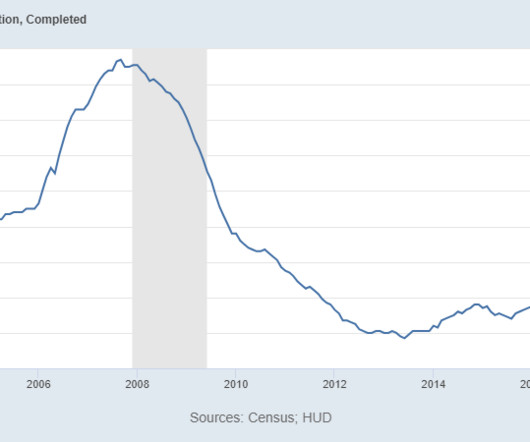

Housing inventory fell last week, but it won’t derail the spring bump

Housing Wire

APRIL 6, 2024

Weekly housing inventory data — both active inventory and new listings — are prone to one-week moves that deviate from a trend, especially if people are going Easter egg hunting. So, the fact that active inventory and new listings data fell last week isn’t a big deal. However, for now, this is a plus for the U.S.

Let's personalize your content