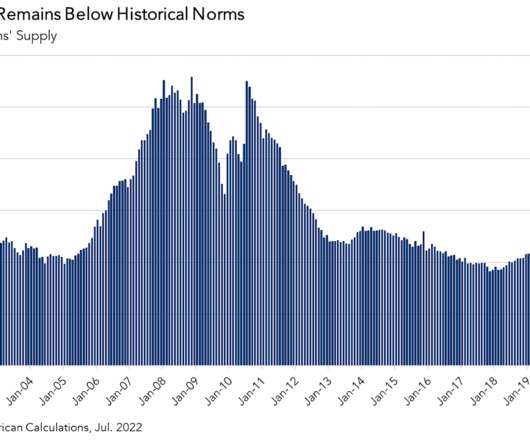

Why home prices haven’t crashed even with high mortgage rates

Housing Wire

DECEMBER 9, 2023

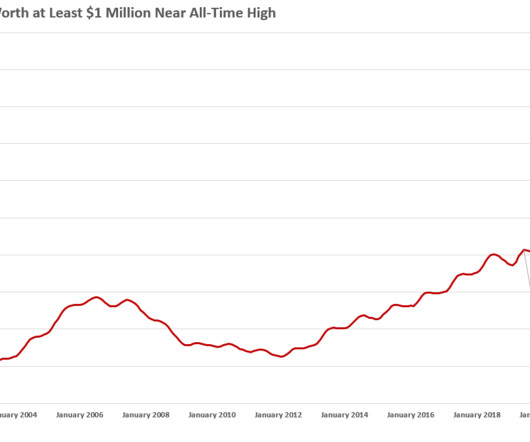

The most underreported housing story I’ve seen this year is that even with mortgage rates rising to 8%, the number of homes that took price cuts before they sold was 4% below 2022 levels. This happened even with higher home prices and higher mortgage rates in 2023. We have a big week ahead of us.

Let's personalize your content