Mortgage rates fall after softer labor data

Housing Wire

AUGUST 4, 2023

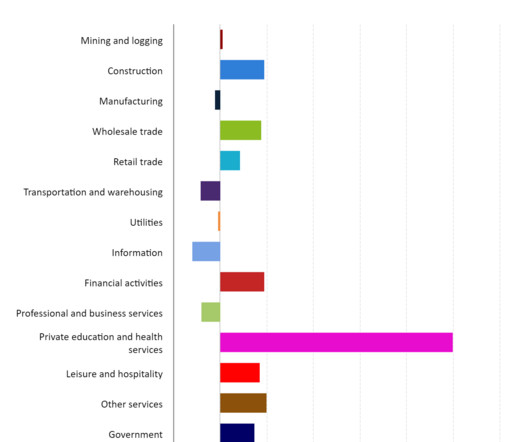

Mortgage rates are finally headed lower after a crazy week of jobs data showing that the economy isn’t going into recession. From BLS : Total nonfarm payroll employment rose by 187,000 in July, and the unemployment rate changed little at 3.5 As you can see in the chart below, the job growth rate is slowing, as it should.

Let's personalize your content