DataDigest: Construction costs easing for homebuilders

Housing Wire

JANUARY 17, 2024

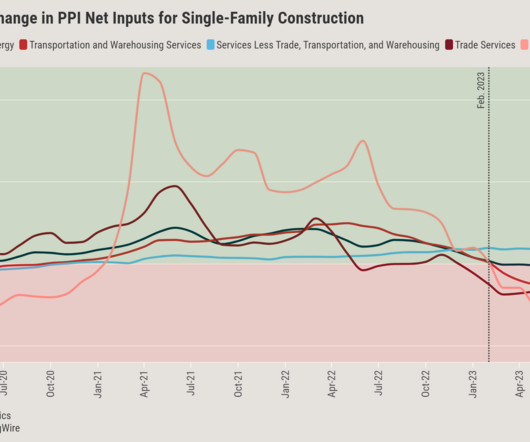

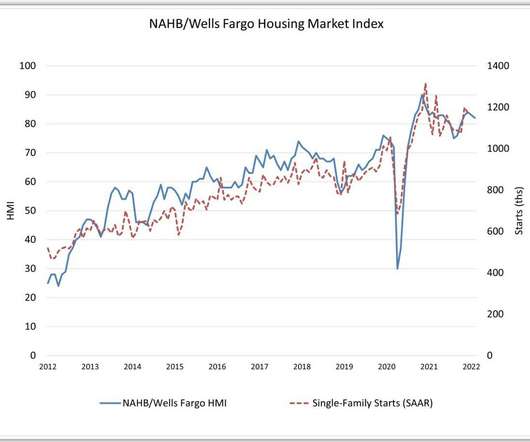

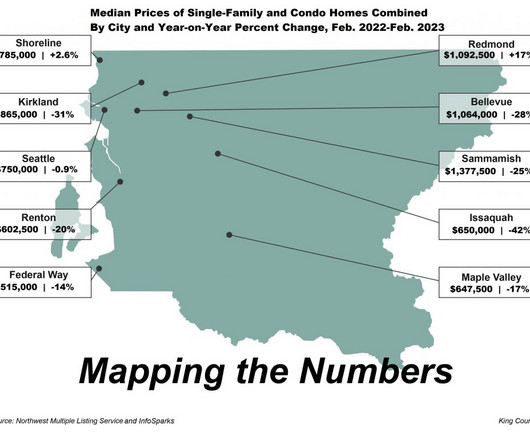

New home construction exploded early in the pandemic as soaring home demand squeezed existing inventory nationwide, giving homebuilders a much bigger share of a shrinking pie. Index values for most construction inputs are down from 2022 but remain above pre-pandemic levels. That could set the backdrop for a slower pace of construction.

Let's personalize your content