Buyers will have more options in 2024, but affordability woes will persist: Bright MLS

Housing Wire

NOVEMBER 30, 2023

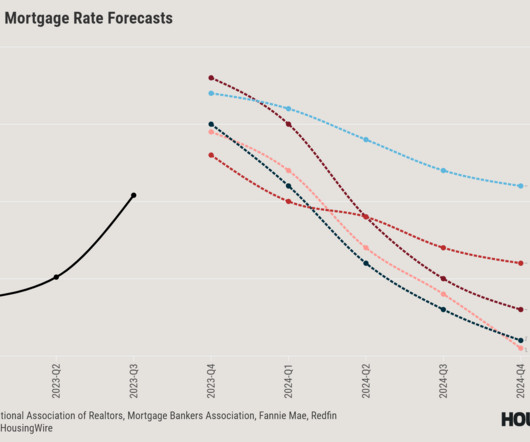

Homebuyer traffic will increase in 2024, fueled by lower mortgage rates and more existing-home inventory. At the same time, both buyers and sellers will have to reset expectations next year for persistently higher mortgage rates and more negotiations during the transaction.” Existing-home sales will end 2024 at 4.6

Let's personalize your content