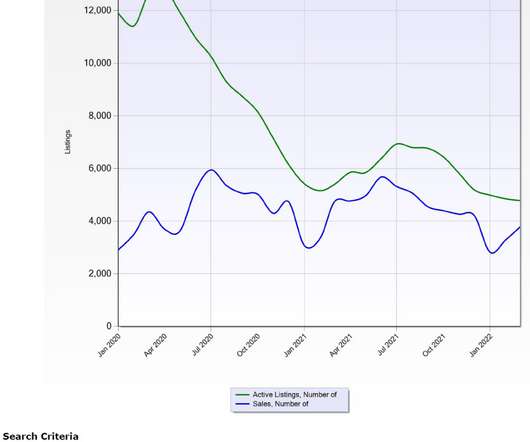

The 2022 housing market: A tale of two halves

Housing Wire

DECEMBER 27, 2022

Marty Green thinks of the housing market in 2022 as two very different movies. The first half of the year, with mortgage rates in the 3s and 4s, was like “Fast and Furious.” But the housing market in the second half of 2022? A mortgage rate lockdown freezes the housing market. over asking price.

Let's personalize your content