Pending home sales shock 2021 housing crash bears

Housing Wire

NOVEMBER 29, 2021

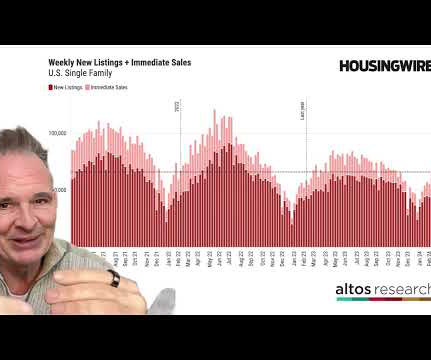

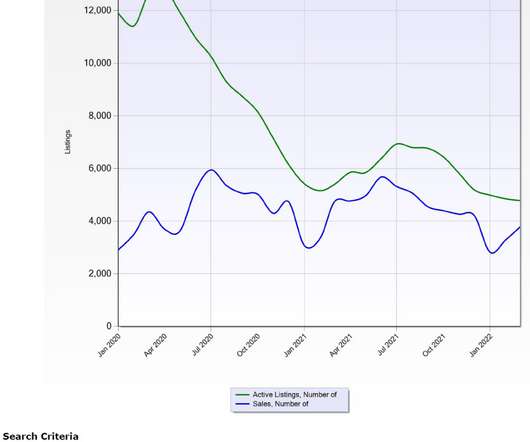

in October — and since we are days away from December, we can officially label the 2021 housing crash bears as even worse than the 2020 housing crash bears. From the National Association of Realtors : “The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, rose 7.5% in October.

Let's personalize your content