Mortgage market affordability and inventory challenges

Housing Wire

JULY 7, 2022

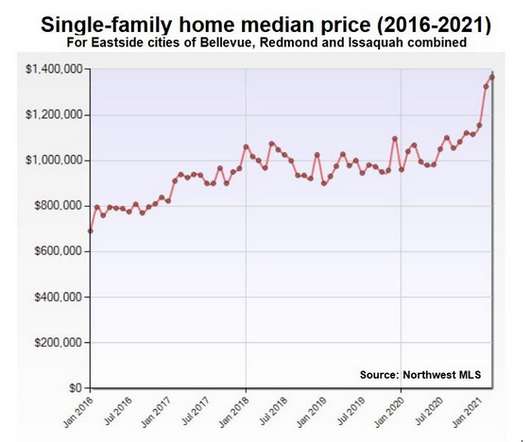

With a rapid spike in interest rates, inventory at historic lows, home prices rising at unprecedented levels above income, and a purchase market that is both highly anxious and digitally reliant, mortgage and real estate professionals must be strategic to capture the market opportunity today. Slow construction and restrictive zoning laws.

Let's personalize your content