Mortgage lenders facing a dark, cold winter

Housing Wire

NOVEMBER 1, 2023

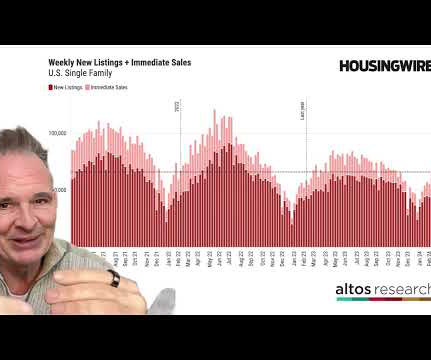

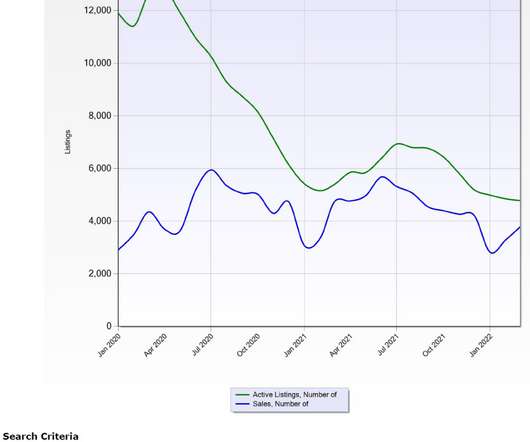

The coming winter is expected to be an existential test of survival for many independent mortgage banks (IMBs), according to leaders of several mortgage advisory firms. “We’re really at the darkest part of the market this winter,” Brian Hale, CEO and founder of consultancy Mortgage Advisory Partners , said. .

Let's personalize your content