Housing inventory has never been lower

Housing Wire

DECEMBER 2, 2021

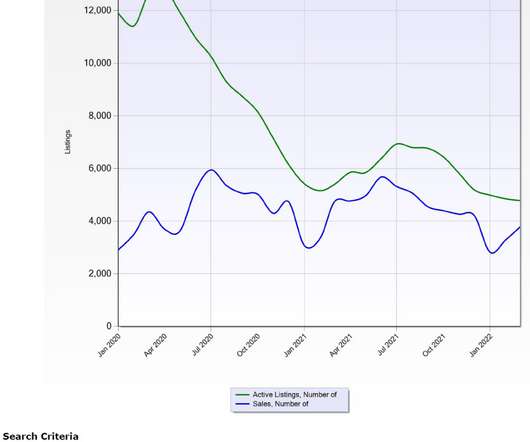

It’s official – housing inventory in America is at a crisis level. During the four week period ending November 28, the number of active listings was a 23% decrease compared to the same time period in 2020 and a 42% drop compared to 2019. This marks a 14% year-over-year increase and a 31% increase from 2019.

Let's personalize your content