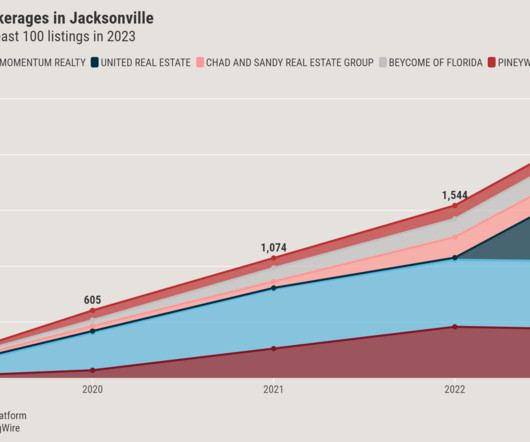

Special report: Jacksonville’s brokerage competition visualized

Housing Wire

MARCH 27, 2024

Its listings in 2023 fell below its 2019 level, although the drop was less steep than that experienced outside of Florida and far less steep than other metros like San Diego. Competition heats up In 2019, Watson Realty Corp. DR Horton and Dream Finders both ranked in the top 10 in 2019, and Lennar made a top 10 appearance in 2020.

Let's personalize your content