When will housing inventory recover?

Housing Wire

MAY 10, 2022

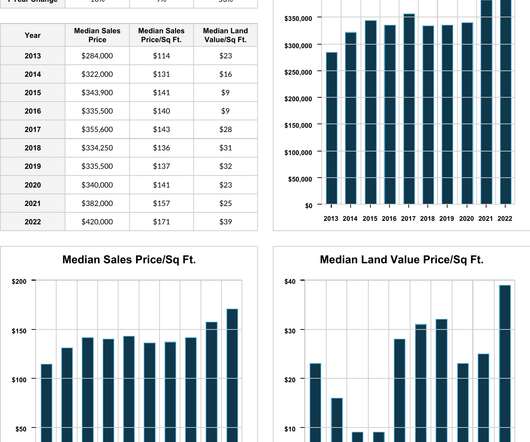

The relative pressure of supply vs. demand in the housing market is gauged by the level of active inventory. Like dropping barometric pressure, plunging inventory usually foretells stormy conditions: Faster price growth and faster sales. But the market is so overheated right now that it will take some time to achieve this balance.

Let's personalize your content