The mortgage rate lock-in didn’t start in 2022

Housing Wire

MAY 15, 2024

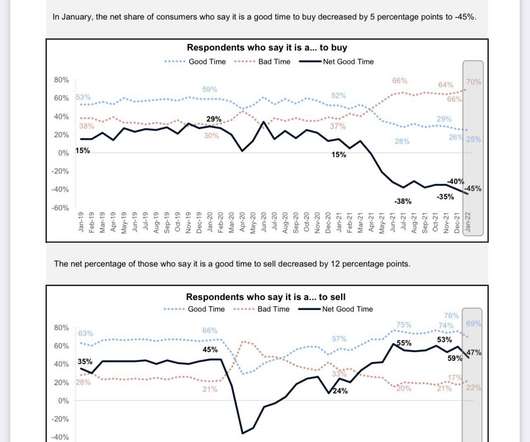

housing market saw dramatic changes in affordability as mortgage rates skyrocketed 500 basis points. After an initial rush to get to market in Q2 2022, new listings volume fell precipitously. That’s a swing of 17% fewer sellers in just a matter of days. The lower rates go, the fewer home sellers we have.

Let's personalize your content