Housing Market Tracker: Inventory drops as mortgage rates move higher

Housing Wire

FEBRUARY 13, 2023

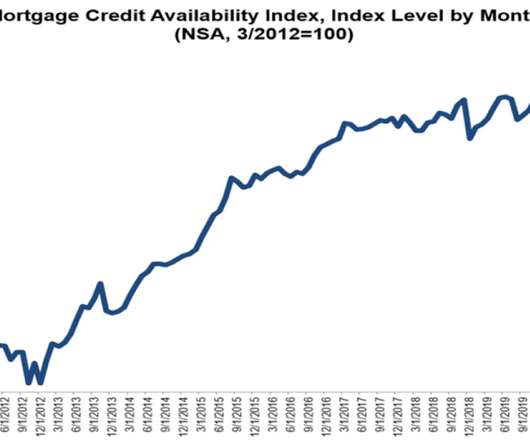

The housing market experienced more volatility last week, with housing inventory dropping as mortgage rates moved higher. The start of 2023 has been good, considering mortgage rates have stayed above 6% most of the time. I am keeping an eye on how much growth we can get with mortgage rates over 6%.

Let's personalize your content