Risks of nonbank mortgage sellers and servicers revisited

Housing Wire

JULY 29, 2021

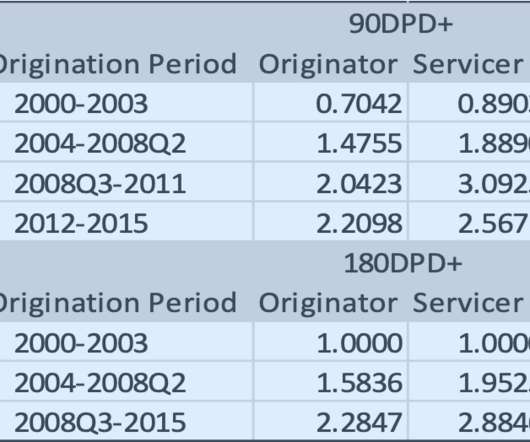

In a comprehensive study of mortgage market liquidity, Liquidity Crises in the Mortgage Market , several well-known academics provided compelling evidence for “liquidity vulnerabilities associated with nonbanks.” These were 2000-2003, 2004-2008Q2, 2008Q3-2011, and 2012-2015.

Let's personalize your content